Estimated Net Worth: $3.1 Billion

Dynasty Age: Over 170 Years

Known For: Paper manufacturing, regional airline ownership, long-term strategic reinvestment

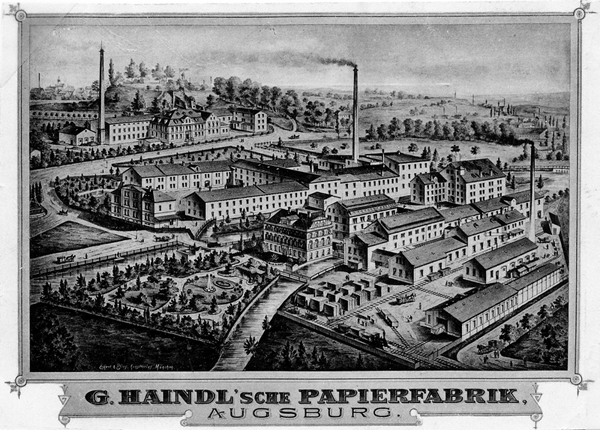

For over 150 years, the Haindl family was one of the silent industrial forces behind Europe’s media machine. From their base in Augsburg, Germany, they turned a regional paper factory into a continental powerhouse—Haindl Papier—supplying virtually every major European publisher with the raw material for newspapers, magazines, and catalogs.

Their story isn’t one of flash or family scandal. It’s one of German precision, postwar resilience, and careful legacy stewardship. And at its heart is one man: Dr. Clemens Haindl, a reluctant heir who became a legendary industrial strategist—and, ultimately, the architect of one of the most graceful exits in modern business history.

From the Mill to the World: A Paper Empire Built Since 1849

The Haindl legacy began in 1849, rooted in the paper trade—a gritty, capital-intensive, and highly cyclical industry that demanded endurance more than flair. For over a century, the Haindl family quietly expanded their business while staying out of the national spotlight, operating in a sector dominated by Scandinavian timber barons and state-supported forestry conglomerates.

By the late 20th century, Haindl Papier was producing 2.8 million tons of paper annually and had become a vital link in Europe’s publishing supply chain. But it wasn’t until the 1990s, under the guidance of Clemens Haindl, that the family business underwent its most dramatic transformation.

Clemens Haindl: The Reluctant Heir Who Became a Strategic Genius

Clemens Haindl didn’t dream of running the family mill. “I was the first escapee,” he said of his decision to study business administration in Munich instead of paper engineering like his brother. He went on to earn a doctorate in industrial sociology, writing his dissertation on continuous four-shift labor structures in the paper industry—a hint that he would one day return, but with a radically different mindset.

In 1970, Clemens joined the family business. Though he began in market research and advertising, he quickly rose to lead the company through some of its most difficult—and most profitable—decades.

By 1992, Haindl Papier was bleeding losses in the double-digit millions. Within eight years, the company was generating over 400 million Deutschmarks in annual profits. Clemens invested early in recycling-based production, realizing that competing with Scandinavia’s cheap electricity and abundant forests would be futile without a fundamental shift. His paper mills began using wastepaper exclusively—a bold, ahead-of-its-time decision that paid off both economically and environmentally.

The $3 Billion Exit—and an Unprecedented Employee Bonus

In 2001, after more than 150 years of Haindl family ownership, Clemens orchestrated the sale of the company to UPM-Kymmene, a Finnish forest industry giant, for a reported €3.6 billion (over $3 billion USD at the time). It was one of the largest industrial acquisitions in Germany that year.

The decision was not without tension. Haindl had hoped to transition the business to either a professional non-family CEO or his nephew, but disputes among the 32 Haindl family co-partners made succession planning impossible. Rather than allow what he called “incompetent shareholders” to steer the ship, he exited on his own terms.

And in a move that stunned the German business community, he shared one percent of the proceeds—approximately 70 million Deutschmarks—with his 4,000 employees. Each received an average bonus of 19,000 Deutschmarks, a gesture that earned him lasting admiration from the workforce and respect from even the most cynical observers.

“It was not my life’s goal to sell this company,” he said. “But it was the right decision—for the business, and for the people.”

More Than a Mogul: The Man Behind the Empire

Outside the boardroom, Clemens Haindl was a man of reflection and taste. He was known for his love of art, collecting thoughtfully and privately. He rode a Harley-Davidson, was a skilled skeet shooter, and approached decisions with the methodical patience of a chess master.

His leadership style was as analytical as it was humane. He didn’t rush. He didn’t posture. And he rarely spoke to the press. But in business and in life, he left a deep and enduring mark.

Dr. Clemens Haindl passed away at the age of 78, remembered as a visionary industrialist, a loyal employer, and one of Augsburg’s most respected entrepreneurs.

The Next Generation: From Industry to Investment

Today, the family’s legacy is carried forward through Clemens Haindl Verwaltungs GmbH, the family office. One of the most visible heirs is Philipp Haindl, head of Serafin Group, a diversified German holding company that is quickly becoming one of the most interesting mid-market acquirers in Europe.

Philipp, in contrast to some other dynastic heirs, is described as a “company collector”—keenly involved in shaping the direction of Serafin’s acquisitions and preferring hands-on influence over passive ownership. His strategy suggests a departure from the conservative playbook of families like the Werhahns or Haniels.

With holdings in consumer goods, packaging, and industrial manufacturing, Serafin reflects both the entrepreneurial DNA of the Haindls and a new generation’s appetite for diversification and control.

Final Thoughts: A German Dynasty, Reinvented

The Haindl family may no longer make the paper that prints Europe’s newspapers, but they remain a case study in how to transition gracefully from industrial dominance to capital stewardship. They didn’t flame out. They didn’t fracture. They exited with dignity, shared their wealth, and reinvested in the future.

In an age when legacy wealth is often squandered or diluted, the Haindl story stands out as a rare example of how to exit smart and re-enter stronger.

From the mills of Augsburg to the family offices of Munich, the Haindls have written one of the most refined chapters in Germany’s industrial history—on their own paper, no less.